The IRS mentions “reasonable cause” for avoiding late payment and late filing penalties. Even if you had a good reason for not paying on time, you will still owe interest.” You will owe interest on any tax not paid by the regular due date of your return. Do not attach the statement to Form 4868.”

Attach a statement to your return fully explaining your reason for filing late.

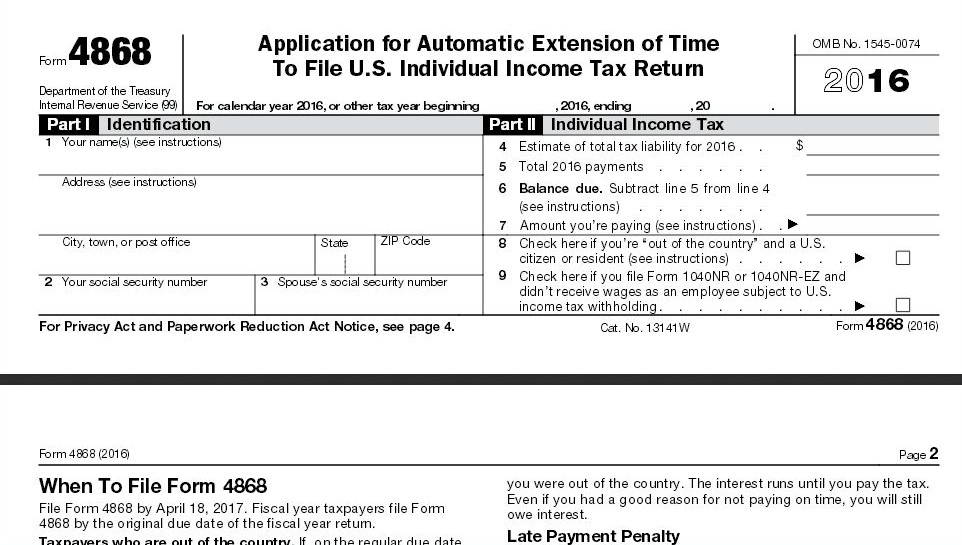

You might not owe the penalty if you have a reasonable explanation for filing late. If your return is more than 60 days late, the minimum penalty is $135 (adjusted for inflation) or the balance of the tax due on your return, whichever is smaller. The penalty is usually 5% of the amount due for each month or part of a month your return is late. A late filing penalty is usually charged if your return is filed after the due date (including extensions). You are considered to have reasonable cause for the period covered by this automatic extension if at least 90% of your actual 2015 tax liability is paid before the regular due date of your return through withholding, estimated tax payments, or payments made with Form 4868. Do not attach the statement to Form 4868. Attach a statement to your return fully explaining the reason. The late payment penalty will not be charged if you can show reasonable cause for not paying on time. It is charged for each month or part of a month the tax is unpaid. The late payment penalty is usually 1⁄2 of 1% of any tax (other than estimated tax) not paid by April 18, 2016.

0 kommentar(er)

0 kommentar(er)